The 5-Minute District Research Workflow for Busy Sales Reps

What to look up before any call, and what to skip. A practical checklist for researching school districts efficiently.

You have a call with Durham Public Schools in 10 minutes. Your CRM shows it's a district in North Carolina with 30,000 students. That's about all you know.

How do you walk into that call prepared?

Most reps either skip research entirely (winging it) or fall down a rabbit hole that eats an hour they don't have. Neither approach serves you.

What you need is a repeatable, efficient workflow that gets you the essential context in 5 minutes or less—enough to have an intelligent conversation without becoming a district data expert.

Here's that workflow.

The 5-Minute Framework

Think of your pre-call research as answering five questions:

- Size: How big is this district, and what does that mean for the sale?

- Money: What's their budget situation?

- Performance: How are they doing academically, and what pressures does that create?

- Demographics: Who are their students, and how does that affect product fit?

- Context: What's happening in this district right now?

You don't need comprehensive answers to each. You need enough to avoid obvious mistakes and ask smart questions.

Step 1: Size Check (30 seconds)

Look up:

- Total enrollment

- Number of schools (elementary, middle, high)

- District type (unified K-12? elementary only? high school only?)

Why it matters:

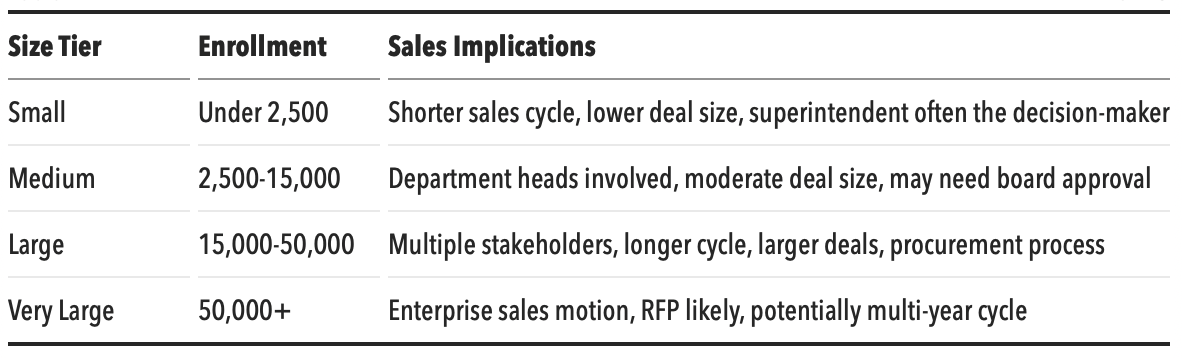

District size fundamentally shapes the sale:

Knowing you're talking to a 30,000-student district tells you immediately that this is a large deal requiring multiple stakeholders and patience.

Quick check:

- What tier does this district fall into?

- Does your typical sales motion match this tier?

Step 2: Budget Snapshot (60 seconds)

Look up:

- Per-pupil spending (and how it compares to state average)

- Revenue breakdown (federal/state/local percentages)

- Any obvious red flags (very low spending, unusual federal dependence)

Why it matters:

You don't need a detailed budget analysis. You need to know:

- Is this a well-resourced district or a financially constrained one? Per-pupil spending above state average suggests resources. Well below average suggests tighter budgets.

- Where does the money come from? High local revenue percentage (50%+) often means more discretionary flexibility. High federal percentage (15%+) means more restricted funds but potentially earmarked for intervention/improvement.

Quick check:

- Is PPS notably high, low, or average for the state?

- Any signal of budget flexibility (high local %) or constraint (very high federal/state %)?

Step 3: Performance Picture (60 seconds)

Look up:

- Math and reading proficiency rates

- How they compare to state average

- Graduation rate (for districts with high schools)

- Any accountability designation (if your state uses A-F or similar)

Why it matters:

Academic performance creates urgency—or complacency.

High-performing districts may feel less pressure to change. Your pitch needs to focus on enhancement, efficiency, or maintaining excellence rather than solving urgent problems.

Struggling districts often have mandates to improve, dedicated funding for intervention, and leadership under pressure to show results. If your product addresses achievement gaps, these are your priority prospects.

Middle-of-the-pack districts can go either way. Look for trends: are they improving (might be satisfied with current approach) or declining (might be seeking solutions)?

Quick check:

- Are they significantly above, below, or near state average?

- Is there an obvious improvement story your product supports?

Step 4: Demographic Snapshot (60 seconds)

Look up:

- Free/Reduced-Price Lunch (FRPL) percentage

- English Language Learner (ELL) percentage

- Students with Disabilities (SWD) percentage

- Racial/ethnic composition (at a glance)

Why it matters:

Demographics affect product-market fit:

High FRPL (50%+): Likely Title I eligible, may have intervention focus, socioeconomic challenges to address. Don't assume "poor district"—remember Title I means additional funding.

High ELL (10%+): Need for language support, bilingual resources, family communication in multiple languages. If your product doesn't support multilingual needs, this is a consideration.

High SWD (15%+): Special education focus, accessibility requirements, IEP compliance needs. If your product isn't accessible, this could be a barrier.

Diverse student body: Cultural relevance in content matters. Representation in your product may be a factor.

Quick check:

- Any demographic factor that directly affects your product's fit?

- Any factor that should inform how you position or demonstrate your solution?

Step 5: Current Context (90 seconds)

Look up:

- Recent news (quick Google search: "[District Name] schools")

- Leadership (who is superintendent, when did they start?)

- Any obvious initiatives or strategic priorities

Why it matters:

Data tells you about a district's structure. Context tells you about its current priorities.

New superintendent? They often want to make changes and may be more receptive to new solutions. They also may be reviewing existing contracts.

Recent news? Bond measure passed (money available), budget cuts announced (money tight), new initiative launched (priorities established), controversy brewing (distracted leadership).

Strategic plan? Many districts publish multi-year strategic plans. If their stated priorities align with your product, reference them.

Quick check:

- Anything in the last 6 months that's relevant to your conversation?

- Any obvious opening ("I saw you recently launched an initiative around...")

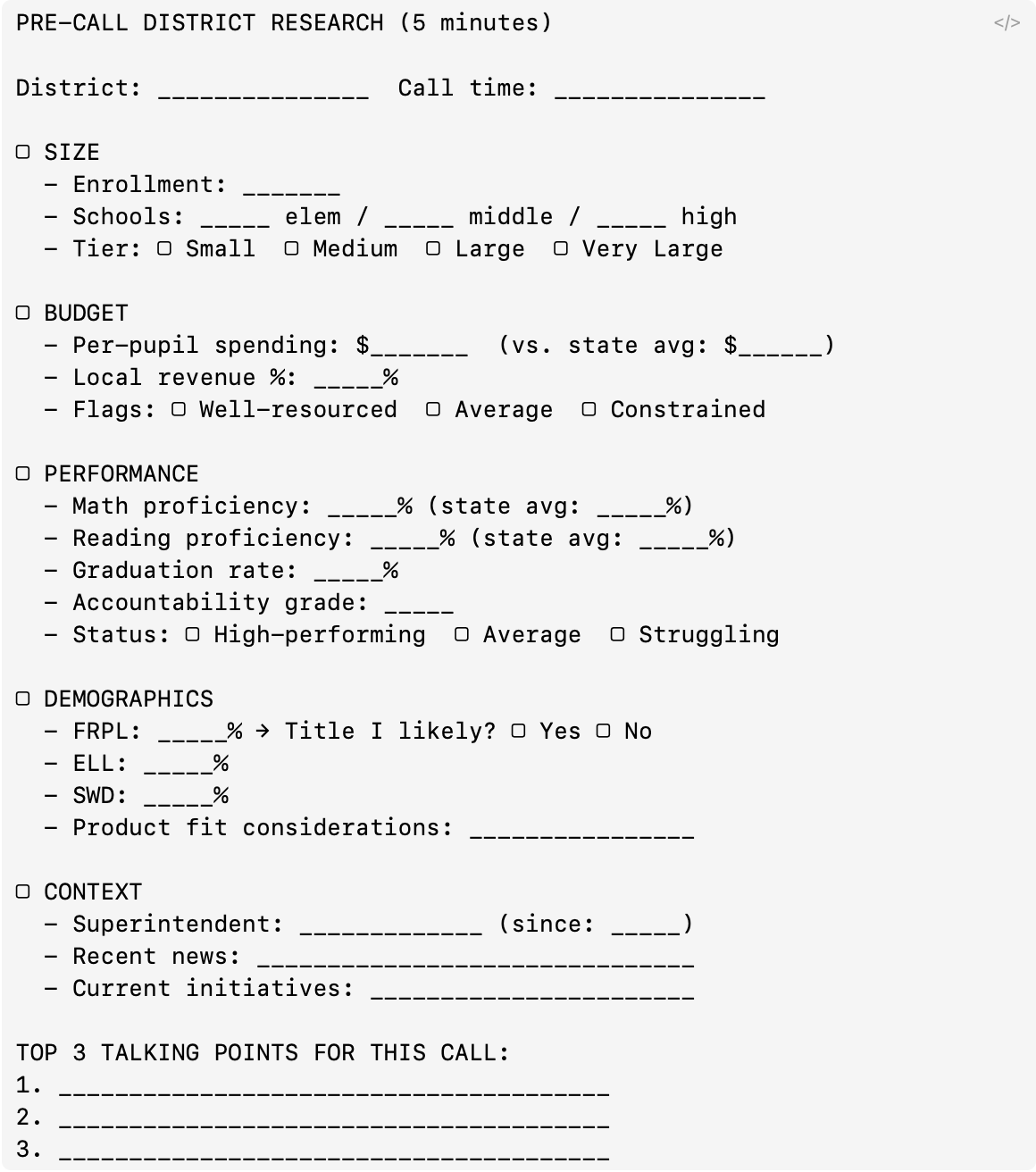

The Quick-Reference Checklist

Copy this checklist and use it before every district call:

Red Flags: When to Dig Deeper (or Walk Away)

Some signals in your 5-minute research warrant more investigation:

Proceed with caution:

- Enrollment declining more than 10% over 5 years (budget stress likely)

- Very high federal revenue dependence (funding instability, heavy compliance burden)

- Recent superintendent turnover (second change in 3 years suggests instability)

- Per-pupil spending well below state average (may lack discretionary budget)

Potential opportunity signals:

- Recent bond measure passed (capital available)

- New superintendent in first 18 months (change agent)

- Declared priority matching your product (strategic alignment)

- High Title I with academic improvement mandate (funded urgency)

Consider deprioritizing:

- Tiny district (under 1,000) unless your product targets small districts specifically

- Very high performance with no obvious enhancement angle

- Explicit recent announcement of budget freeze or cuts

What You Can Skip

In 5 minutes, you can't learn everything. Here's what's okay to skip:

Skip for now:

- Detailed budget line items (too granular for pre-call)

- Historical trend analysis (good for proposals, not initial calls)

- Individual school profiles (unless you know you're talking to a principal)

- Board member names (unless this is an advanced-stage deal)

- Competitor intelligence (important, but a separate research task)

Ask instead:

- "What are your top priorities this year?"

- "How does your budget cycle work here?"

- "What solutions are you currently using for [your category]?"

- "Who else would be involved in evaluating something like this?"

Five minutes of research plus good discovery questions beats an hour of research and no questions every time.

Putting It Together: An Example

Let's walk through a real example using this workflow:

District: Wake County Public Schools, NC

Step 1 - Size (30 sec):

- Enrollment: ~160,000 students

- Schools: 120+ elementary, 35+ middle, 30+ high

- Tier: Very Large (enterprise sale, complex stakeholders, likely RFP)

Step 2 - Budget (60 sec):

- Per-pupil spending: ~$10,800 (near NC average)

- Local revenue: ~35%

- Assessment: Average resources, moderate local flexibility

Step 3 - Performance (60 sec):

- Proficiency: Above state average

- Graduation rate: ~90%

- Assessment: High-performing, pitch enhancement rather than turnaround

Step 4 - Demographics (60 sec):

- FRPL: ~35% (moderate, some Title I schools)

- ELL: ~12% (meaningful population, multilingual matters)

- SWD: ~13%

- Assessment: Diverse needs, language support relevant

Step 5 - Context (90 sec):

- Superintendent: Relatively recent (check exact tenure)

- News: Large, growing district, frequent news coverage

- Priorities: Check for strategic plan on district website

Summary going into call:

"Wake County is the largest district in NC—this is an enterprise opportunity requiring multiple stakeholders and patience. They're high-performing and well-resourced, so I should pitch enhancement and efficiency rather than turnaround. With 12% ELL, I should be ready to discuss multilingual capabilities. They're likely sophisticated buyers who've seen many vendors."

That's what 5 minutes of focused research produces: a clear frame for the conversation and obvious things to avoid saying.

Making This Faster Over Time

Your first few times using this workflow might take 7-8 minutes. With practice, you'll get faster:

Week 1-2: Follow the checklist explicitly, lookup each itemWeek 3-4: Start recognizing patterns (this looks like a typical suburban district...)Month 2+: Scan for exceptions to expected patterns (what's unusual here?)

Eventually, you'll develop intuition for what a district "should" look like and immediately notice when something doesn't fit. That's when your research becomes truly efficient—you spend time on surprises, not on confirming the expected.

Tools for the Workflow

Where to find this data quickly:

- EduSignal: One place for enrollment, finances, demographics, and academic performance (shameless plug—but we built it for exactly this use case)

- NCES District Search: Federal data, but clunky interface and 2-year lag

- State DOE websites: Most current performance data, but varies by state

- Google News: "[District name] schools" for recent context

- District website: Strategic plan, leadership page, news/announcements

The workflow works with whatever tools you have. The efficiency comes from knowing what to look for, not from any particular data source.

---

The 5-Minute Mindset

You don't need to be a district data expert. You need to know enough to:

- Not say something dumb (like asking a 160,000-student district if they've tried your small-school solution)

- Show you've done your homework (referencing something specific about their context)

- Ask smarter questions (building on what you know rather than starting from zero)

- Position appropriately (matching your pitch to their situation)

Five minutes of focused research accomplishes all of this. An hour of research doesn't accomplish it four times better—it just delays your call.

Do the 5 minutes. Make the call. Learn the rest through conversation.