The Proficiency Paradox: Why Low Test Scores Often Mean High Sales Potential

Counter-intuitive but true: struggling schools frequently have more budget, more urgency, and more reason to buy than high performers

When reviewing district profiles, many EdTech sales reps instinctively skip past districts with low proficiency rates. The logic seems sound: struggling schools must be struggling for a reason, probably lack of resources. Better to focus on well-funded, high-performing districts that can afford quality solutions.

This instinct is often wrong.

In reality, low academic performance frequently correlates with more purchasing potential, not less. Struggling schools face accountability pressure that creates urgency. Federal and state intervention programs bring dedicated funding. The mandate to improve isn't optional—it's legally required.

Welcome to the proficiency paradox: the districts with the biggest academic challenges are often your best sales opportunities.

---

The Logic Behind the Paradox

Let's break down why low performance creates buying conditions:

1. Federal Funding Follows Need

Title I, the largest federal education program at ~$18 billion annually, explicitly targets schools with high concentrations of poverty—which strongly correlates with lower academic performance.

Title I schools receive additional funding for:

- Instructional materials and curriculum

- Intervention and remediation programs

- Educational technology

- Professional development

- Extended learning time

A high-poverty, low-performing school might receive an additional $500-$2,000+ per student in Title I funds beyond its base budget. That's not a sign of poverty—it's a targeted infusion of resources.

2. Accountability Systems Create Mandates

Every state has an accountability system that identifies low-performing schools and requires them to improve. These systems create consequences:

At the federal level (ESSA):

- Schools in the bottom 5% must implement improvement plans

- Consistent underperformers face escalating interventions

- Federal funding can be conditioned on implementing specific strategies

At the state level:

- Schools receiving D or F grades face public pressure and oversight

- Improvement plans often require adopting evidence-based interventions

- Some states mandate specific actions for persistently low performers

These mandates aren't suggestions. A superintendent with multiple F-rated schools doesn't have the luxury of waiting to address the problem. They're required to act—and acting usually means purchasing solutions.

3. Improvement Timelines Are Compressed

When a school is identified for improvement, there's typically a defined timeline:

- Year 1: Develop improvement plan

- Year 2-3: Implement strategies

- Year 4+: Demonstrate results or face escalation

This timeline creates purchasing urgency that high-performing districts don't have. A stable B-rated district can evaluate solutions for two years before deciding. A D-rated district under state oversight needs to show they're doing something now.

4. "Evidence-Based" Requirements Favor EdTech

Federal and state improvement requirements often mandate "evidence-based interventions"—programs that can demonstrate research support for effectiveness.

Many EdTech solutions have conducted efficacy studies specifically to meet this requirement. A district under improvement pressure can't just buy whatever seems interesting; they need to justify purchases to oversight bodies. Solutions with evidence bases have an advantage.

5. Dedicated Improvement Funding Exists

Beyond Title I, multiple funding streams target school improvement:

- School Improvement Grants (SIG): Federal funds specifically for low-performing schools

- State improvement allocations: Many states provide additional funding for identified schools

- Turnaround specialist positions: Dedicated staff focused on improvement, often with their own budgets

- Grant opportunities: Foundations and government grants often target struggling schools specifically

A school in improvement status often has access to funding that a higher-performing school in the same district does not.

---

The Data Pattern

Let's look at how this plays out in the data.

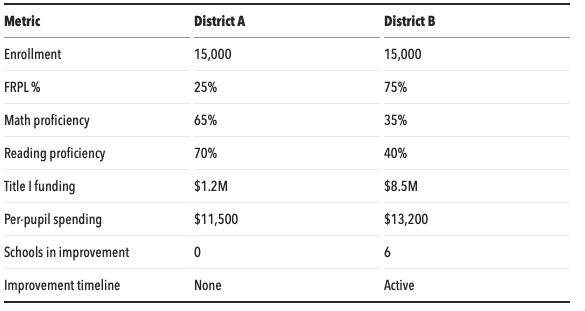

Consider two hypothetical districts with similar enrollment:

District A looks healthier by performance metrics, but District B has:

- 7x more Title I funding dedicated to instructional improvement

- Higher per-pupil spending (federal supplements add up)

- Active improvement mandates requiring evidence-based intervention purchases

- Six schools with dedicated improvement plans and budgets

Which district has more urgency to buy intervention software? Which has dedicated funding for it? Which has oversight bodies asking what they're doing to improve?

The "struggling" district is often the better sales opportunity.

---

Recognizing the Signals

Not every low-performing district is a great opportunity. Here's how to distinguish between "funded urgency" and "unfunded problems":

Green Lights: High Potential

High Title I allocation: Look for FRPL rates above 50%. These districts qualify for significant federal supplements.

Recent improvement identification: Schools newly identified for improvement have fresh urgency and often newly allocated funds.

State with strong accountability: States like Texas, Florida, and North Carolina have robust accountability systems that create real consequences.

Active turnaround leadership: Superintendents hired to "turn around" struggling districts often arrive with mandates and budgets to make changes.

Combination of challenges: Districts with both low performance AND declining enrollment may be cutting elsewhere but still required to invest in improvement.

Yellow Lights: Proceed with Caution

Very small districts: Even with Title I funding, tiny districts may lack the total budget for significant purchases.

Districts with state takeover/receivership: Extreme intervention cases have complex governance that can slow procurement.

High leadership turnover: If the superintendent changes every year, long-term initiatives struggle.

States with weak accountability: Where there's no real consequence for low performance, there's less urgency to act.

Red Lights: Actual Problems

Financially distressed districts: Some states have districts in genuine financial emergency—these are different from "low performing with improvement funding."

Chronic instability: Ongoing board conflicts, legal issues, or community turmoil make any purchase difficult.

Newly struggling: A district that just dropped in scores may not yet have improvement funding or developed urgency.

---

Positioning for Improvement-Focused Sales

When selling to low-performing districts, adjust your approach:

Lead with Outcomes, Not Features

Districts under improvement pressure care about results above all. They need to demonstrate student achievement gains to oversight bodies. Your pitch should lead with:

- Efficacy data and research support

- Case studies from similar districts that improved

- Measurable outcome expectations

- How you'll help them demonstrate success to reviewers

Understand Their Accountability Timeline

A district in Year 3 of a 4-year improvement cycle has very different urgency than one just identified. Ask:

- "When was the school/district identified for improvement?"

- "What does your improvement timeline look like?"

- "What metrics are you being held accountable for?"

Know the Funding Sources

Different funding streams have different rules. Understand:

- Title I allowable uses (your product should align)

- State improvement fund requirements

- Grant restrictions and reporting needs

Be prepared to help them justify the purchase within their funding constraints.

Expect More Scrutiny, Not Less

Improvement-funded purchases often face more review, not less. Oversight bodies want to ensure funds are spent on evidence-based interventions. Be ready with:

- Research citations and efficacy evidence

- Documentation for compliance

- Alignment to their improvement plan

- Clear implementation and outcome tracking

Partner on Reporting

Districts in improvement must report progress. Position your solution as helping them tell their improvement story:

- Dashboard data they can share with oversight

- Progress metrics aligned to accountability requirements

- Documentation of implementation fidelity

---

Ethical Considerations

Selling to struggling schools comes with ethical responsibilities that you should take seriously:

Do Deliver Value

If you win a contract because the district is mandated to try something, you have an obligation to deliver. These schools need solutions that work—they can't afford to waste limited improvement cycles on products that don't deliver.

Don't Exploit Desperation

The urgency of improvement mandates can create pressure that leads to poor decisions. Don't take advantage of compressed timelines to push unsuitable solutions. A bad implementation hurts students who are already behind.

Be Honest About Fit

Not every product fits every improvement context. If your solution isn't well-suited to their specific challenges, say so. Recommending a poor-fit product to a struggling school is harmful and will damage your reputation.

Support Implementation

Struggling schools often have implementation capacity challenges—staff stretched thin, leadership turnover, multiple competing initiatives. Plan for more support, not less, when serving improvement-focused districts.

Think Long-Term

Short-term contract wins that fail don't build your business. Success stories from schools that actually improved build your brand and create references. Approach these opportunities as partnerships, not transactions.

---

Case Study: The Intervention Buying Cycle

Here's how improvement funding typically flows into purchasing decisions:

Year 0 (Identification)A school receives a D grade and is identified for improvement. State oversight begins. The district must develop an improvement plan within 90 days.

Year 1 (Planning)Improvement plan is submitted and approved. Plan specifies evidence-based interventions in priority areas (typically literacy and math). Budget is allocated from Title I and state improvement funds. Procurement begins for identified interventions.

Sales opportunity: Get included in the improvement plan; be part of the approved strategy

Year 2 (Implementation)Interventions are implemented. Progress monitoring begins. Adjustments made as needed. Additional purchases may occur to support initial interventions.

Sales opportunity: Complementary products, professional development, expansion to other schools

Year 3-4 (Evaluation)Outcomes measured against improvement targets. If progress is shown, school may exit improvement status. If not, escalation occurs with potential for additional interventions.

Sales opportunity: If current interventions aren't working, openness to new approaches increases

The typical cycle creates multiple entry points for vendors who understand the timeline.

---

Key Metrics to Watch

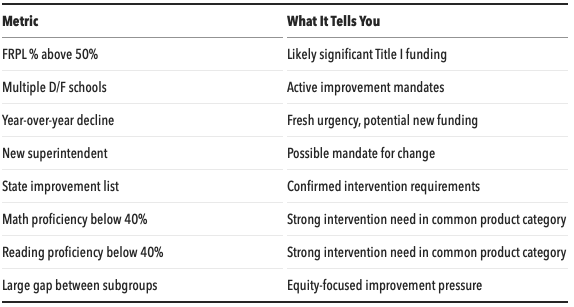

When prospecting in low-performing districts, track these indicators:

---

The Bottom Line

The proficiency paradox is real: low-performing districts often have more purchasing potential than high performers because:

- Federal and state funding follows need

- Accountability systems mandate action

- Improvement timelines create urgency

- Evidence-based requirements favor prepared vendors

- Dedicated improvement dollars exist beyond base budgets

This doesn't mean every struggling school is a great prospect. You need funded urgency, not just problems. But if you're instinctively deprioritizing low-performing districts, you're likely missing significant opportunities.

The districts with the most to gain from improvement are often the ones with the most resources dedicated to achieving it. Position yourself as a partner in their improvement journey, and you'll find receptive buyers with real budgets.