North Carolina Education Data Guide for EdTech Sales

Everything you need to know about NC's 115 school districts: structure, data sources, regional patterns, and what makes the Tar Heel State unique.

.jpg&w=3840&q=75)

North Carolina is a state of contrasts. It's home to the Research Triangle's booming tech economy and some of the most rural, economically challenged counties in the Southeast. It has rapidly growing suburban districts and shrinking rural systems. It's educationally ambitious but politically complex.

For EdTech sales teams, NC represents a significant opportunity: 115 local education agencies (LEAs), nearly 1.5 million students, and a state that has made education a priority—even amid ongoing debates about funding and policy.

This guide covers everything you need to know to sell effectively in North Carolina.

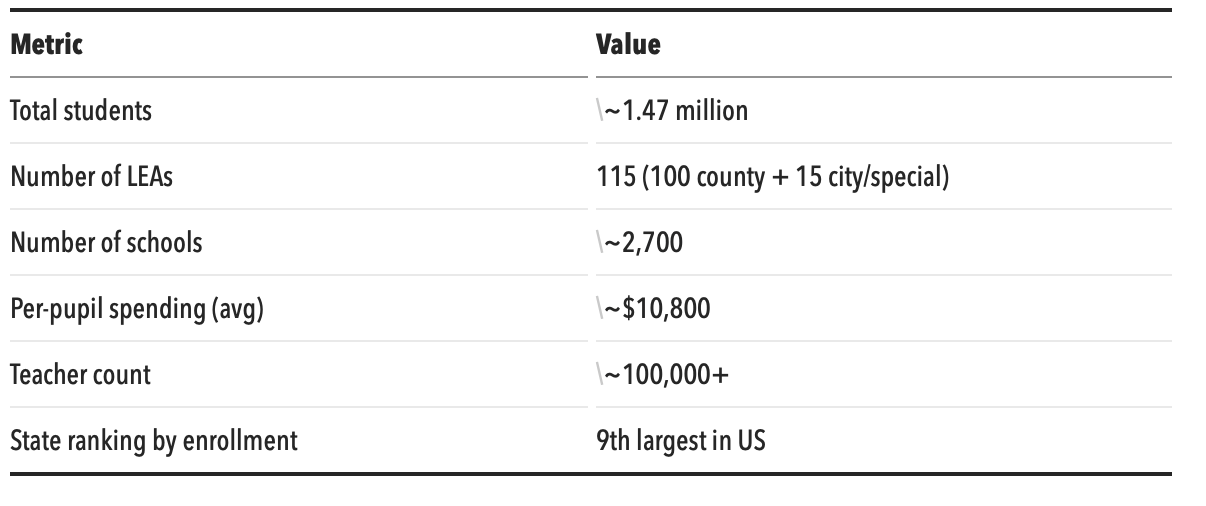

The Basics: NC at a Glance

NC is the 9th largest state by K-12 enrollment, making it a meaningful market for any EdTech company with a national or regional focus.

Understanding NC's District Structure

Unlike some states with thousands of tiny districts or a few mega-districts, North Carolina has a distinctive structure that's important to understand:

County-Based System

North Carolina uses a county-based system for most school districts. Each of the state's 100 counties has at least one school district, and the district typically serves the entire county.

This means:

- District boundaries generally follow county lines

- Most districts are mid-sized (5,000-30,000 students)

- Very few tiny districts (unlike states with township-based systems)

- Geographic coverage is predictable

City School Districts

In addition to county districts, NC has 15 city school districts that operate independently within certain municipalities:

- Asheville City Schools

- Chapel Hill-Carrboro City Schools

- Clinton City Schools

- Elkin City Schools

- Hickory City Schools

- Kannapolis City Schools

- Lexington City Schools

- Mooresville Graded School District

- Mount Airy City Schools

- Newton-Conover City Schools

- Roanoke Rapids City Schools

- Thomasville City Schools

- Weldon City Schools

- Whiteville City Schools

- Winston-Salem/Forsyth County Schools (consolidated but historically city)

City districts tend to be smaller and serve urban cores, while the surrounding county district serves suburban and rural areas. When prospecting, be aware that a county might have two separate districts to contact.

Charter Schools

NC has a significant and growing charter school sector (~200 charter schools, ~130,000 students), but these operate independently from traditional LEAs. They're not included in the 115 LEA count and typically require a different sales approach.

NC's Regional Landscape

North Carolina has distinct regional characteristics that affect education and purchasing:

The Piedmont Triad (Greensboro-Winston-Salem-High Point)

Districts: Guilford County, Winston-Salem/Forsyth County, Davidson County, Randolph County, others

Characteristics:

- Manufacturing heritage transitioning to healthcare, logistics

- Mixed urban/suburban/rural within counties

- Moderate to declining enrollment in some areas

- Diverse student populations

Key districts:

- Guilford County Schools (~70,000 students) – One of NC's largest, diverse urban/suburban

- Winston-Salem/Forsyth County (~52,000 students) – Major district, consolidated city/county

The Research Triangle (Raleigh-Durham-Chapel Hill)

Districts: Wake County, Durham Public Schools, Chapel Hill-Carrboro, Orange County

Characteristics:

- Fastest-growing region in NC

- High education levels, high expectations

- Tech-savvy communities

- Higher income but also significant diversity

- Competitive, with many EdTech vendors active

Key districts:

- Wake County Public Schools (~160,000 students) – Largest in NC, 15th largest in US

- Durham Public Schools (~30,000 students) – Urban, diverse, university town

- Chapel Hill-Carrboro (~12,000 students) – Small, high-performing, affluent

Charlotte Metro

Districts: Charlotte-Mecklenburg, Cabarrus County, Union County, Gaston County, Iredell-Statesville

Characteristics:

- Major banking/finance hub

- Rapid suburban growth (especially Union County)

- Significant wealth alongside urban poverty

- Politically moderate suburban districts

Key districts:

- Charlotte-Mecklenburg Schools (~140,000 students) – 2nd largest in NC, major urban challenges and opportunities

- Union County (~40,000 students) – Fast-growing affluent suburban

- Cabarrus County (~35,000 students) – Growing suburban, NASCAR country

Coastal Plain / Eastern NC

Districts: Pitt County, Onslow County, Wayne County, New Hanover County, many smaller rural counties

Characteristics:

- Mix of military (Onslow/Camp Lejeune), university (Pitt/ECU), beach communities (New Hanover)

- Significant rural poverty in many counties

- High Title I populations

- Hurricane vulnerability (affects budgets, priorities)

Key districts:

- New Hanover County (~27,000 students) – Wilmington area, coastal growth

- Pitt County (~24,000 students) – Greenville, ECU influence

- Onslow County (~24,000 students) – Military families, transient population

Western NC / Mountains

Districts: Buncombe County, Henderson County, many small mountain districts

Characteristics:

- Tourism and retirement economy

- Small, spread-out districts

- Rural challenges with mountain geography

- Growing Asheville metro

Key districts:

- Buncombe County (~23,000 students) – Asheville area, progressive community

- Asheville City Schools (~4,000 students) – Small urban district, alternative vibe

- Henderson County (~13,000 students) – Growing retirement/tourism area

Rural Tier 1 Counties

NC designates economically distressed counties as "Tier 1" for economic development purposes. Many of these are rural counties with:

- High poverty rates

- Declining enrollment

- Limited local tax base

- Strong dependence on state and federal funding

- Significant need for intervention and support

These districts often have the greatest need for EdTech solutions but may have procurement challenges and smaller deal sizes.

---

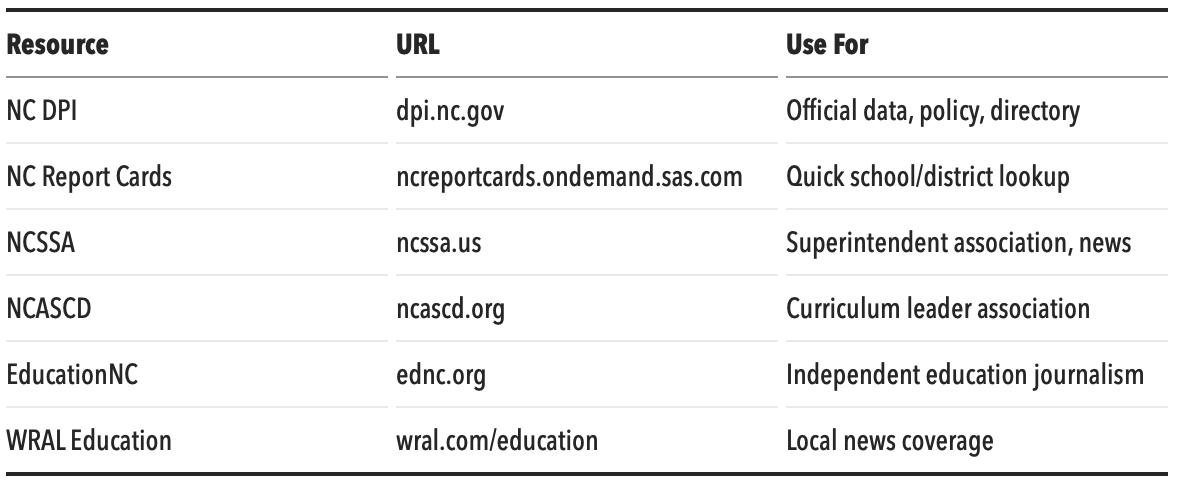

NC Education Data Sources

NC Department of Public Instruction (NC DPI)

The primary source for NC-specific education data:

Website:

Key data available:

- Assessment results (NC End-of-Grade, End-of-Course tests)

- School performance grades (A-F)

- Graduation rates

- Enrollment by school and district

- Financial data

- Teacher data

Data freshness: Assessment data is typically available by September for the prior school year. NC DPI is relatively good about timely data release.

NC School Report Cards

Website:

Public-facing dashboard with school and district performance data, demographics, and other metrics. Good for quick lookups.

EDDIE (Education Data Dashboard)

NC DPI's interactive data system for exploring education statistics. More detailed than report cards but steeper learning curve.

Federal Sources (NCES)

National data that includes NC districts:

- Common Core of Data (CCD) – enrollment, staffing, basic finances

- F-33 Finance Survey – detailed financial data (2-3 year lag)

- EDFacts – assessment and accountability data

---

NC's Accountability System

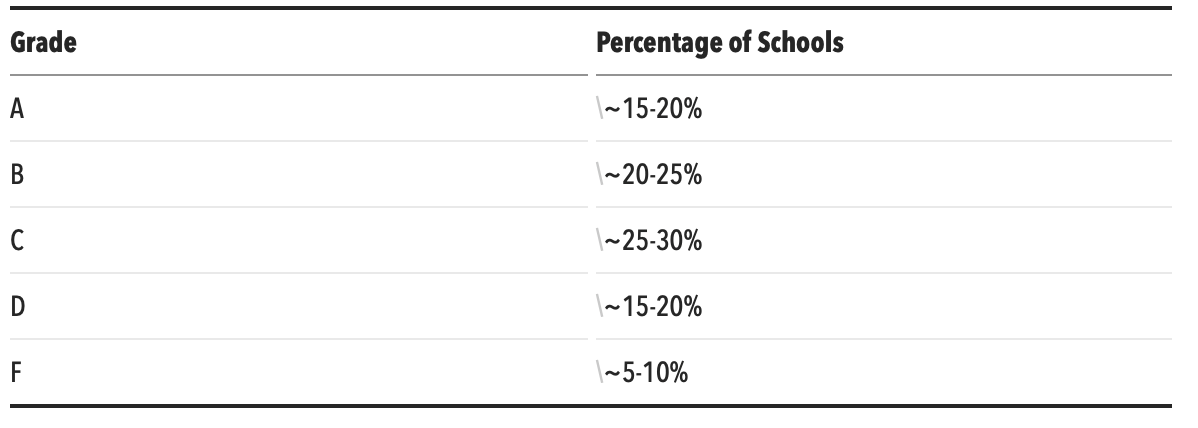

North Carolina uses an A-F school performance grading system that's important to understand for sales conversations:

How It Works

Each school receives a letter grade (A-F) based on:

- 80% Achievement: Proficiency on state assessments (End-of-Grade for elementary/middle, End-of-Course for high school)

- 20% Growth: Student academic growth compared to expectations

Grade Distribution (Typical Year)

What This Means for Sales

High-performing (A-B) schools:

- Less urgent pressure to change

- May have more resources and sophistication

- Pitch: enhancement, enrichment, efficiency

Middle-tier (C) schools:

- May be complacent or actively trying to improve

- Look for those trending downward (urgency) or upward (momentum)

- Pitch: move from good to great

Low-performing (D-F) schools:

- Under state scrutiny and improvement mandates

- Often have additional funding for intervention

- May have prescribed improvement plans limiting flexibility

- Pitch: proven intervention, evidence-based results

Schools Identified for Improvement

NC identifies low-performing schools for additional support and oversight:

- Low-Performing Schools: Schools with D or F grades, with significant additional requirements

- Recurring Low-Performing: Schools low-performing for two or more consecutive years face escalating interventions

Districts with multiple low-performing schools face significant pressure and often have earmarked improvement funding.

NC Assessment Data

NC uses its own state assessments (not a consortium like Smarter Balanced or PARCC):

End-of-Grade (EOG) Tests

- Grades 3-8, Reading and Math

- Grade 5 and 8 Science

End-of-Course (EOC) Tests

- High school: Math I, English II, Biology

Proficiency Levels

NC reports results using proficiency levels:

- Level 5: Superior command

- Level 4: Solid command (grade-level proficient)

- Level 3: Sufficient command (grade-level proficient)

- Level 2: Partial command (not proficient)

- Level 1: Limited command (not proficient)

"Grade Level Proficient" (GLP) = Levels 3, 4, or 5

When looking at proficiency rates, you'll see the percentage of students achieving GLP. Statewide rates typically range from 45-60% depending on subject and year.

Using Assessment Data in Sales

- Compare to state average: Is this district above or below? By how much?

- Look at trends: Improving, stable, or declining over 3-5 years?

- Check subgroup gaps: How do different student populations compare?

- Math vs. Reading: Often different stories in the same district

NC Funding Landscape

State Funding Formula

NC uses a position-based funding model (allocating teacher and staff positions based on enrollment) rather than a pure per-pupil formula. This means:

- Districts receive allocations for positions, not just dollars

- Flexibility to convert positions to dollars is limited

- Per-pupil spending comparisons can be misleading

The Leandro Case

No discussion of NC education funding is complete without mentioning Leandro – a long-running court case (since 1994) that found NC is not meeting its constitutional obligation to provide a sound basic education to all students.

Current status: Courts have ordered the state to implement comprehensive remediation, including significant additional funding. This is politically contentious and implementation is uncertain.

Why it matters for sales: Leandro creates ongoing conversation about education investment. If remediation funding flows, it could mean significant new resources—particularly for low-wealth districts. Watch for updates.

Local Funding Variation

Counties have discretion in supplementing state funding with local dollars. This creates significant variation:

- Wealthy counties (Wake, Mecklenburg, Orange) supplement significantly

- Poor rural counties have little capacity to supplement

- Per-pupil spending can vary by $3,000+ across districts

Federal Funding

NC districts receive typical federal allocations:

- Title I: ~$400-500 million annually statewide

- IDEA: Special education funding

- ESSER (pandemic relief): Significant one-time funding, but winding down

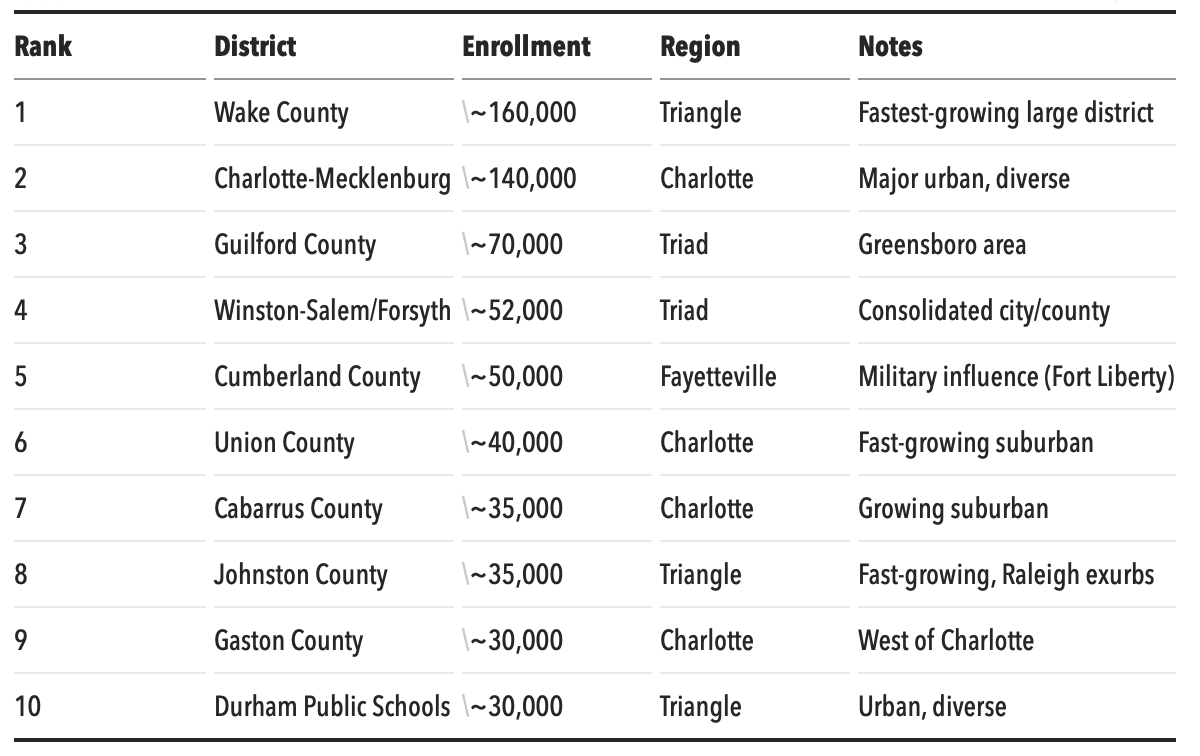

NC's Largest Districts

A quick reference for the biggest opportunities:

These 10 districts serve roughly 40% of NC's students.

The NC Buying Cycle

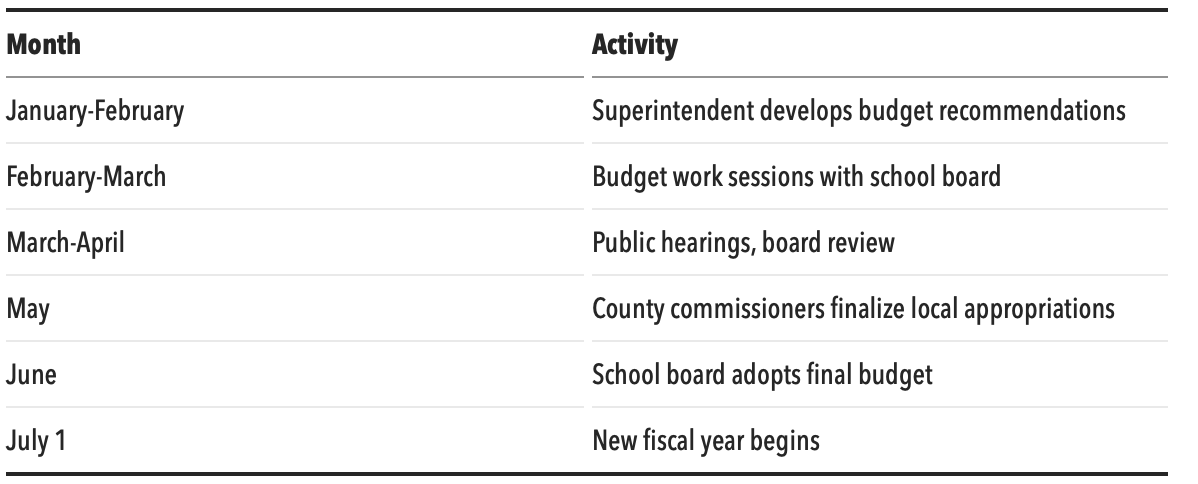

Fiscal Year

NC school districts operate on a July 1 – June 30 fiscal year, aligned with the state fiscal year.

Budget Development Timeline

Best Times to Engage

October-December: New school year underway, current year priorities established, good time for discovery and relationship-building

January-March: Budget planning season, decision-makers thinking about next year, good time for proposals

April-May: Procurement for next year, good time for closing

June: End-of-year spending (use-it-or-lose-it for some funds), can be rushed

July-August: New fiscal year, implementation mode, tough time for new decisions unless planned earlier

NC Procurement Considerations

State Contract Vehicles

NC has state-level contracts that can simplify procurement:

NC E-Procurement: The state's electronic purchasing system. Some educational technology is available through state contracts.

NCSSA (NC School Superintendents Association): Offers some consortium purchasing.

National Cooperatives: TIPS, BuyBoard, Sourcewell, and others are valid in NC.

Local Purchasing Thresholds

NC has relatively high informal purchasing thresholds:

- Under $30,000: Generally informal purchasing allowed (quotes, not formal bids)

- $30,000-$90,000: Informal bids, documented process

- Over $90,000: Formal bidding typically required

These thresholds mean many EdTech deals can be completed without formal RFP processes.

Board Approval

Larger purchases typically require school board approval. Board meetings are usually monthly. Factor this into your timeline.

Key Contacts and Decision-Makers

At the District Level

Superintendent: Final authority, but typically engaged only for largest or most strategic purchases

Assistant/Associate Superintendent for Curriculum & Instruction: Often the key decision-maker for instructional technology

Chief Technology Officer / Director of Technology: Key for infrastructure, devices, systems. May have budget authority for technology purchases.

Director of Federal Programs / Title I Coordinator: Essential contact if pursuing Title I funding

Curriculum Directors/Coordinators: Subject-specific (Math, ELA, etc.) – important for curriculum-aligned products

Principals: Increasingly have discretionary budgets, especially in larger districts

At the State Level

NC DPI: Sets policy, provides guidance, but doesn't generally purchase for districts

Regional Education Service Alliances: NC is organized into regions with support organizations. Not purchasing authorities but can be influencers.

Competitive Landscape in NC

NC is an attractive market, so competition is real:

Well-penetrated product categories:

- Student Information Systems (PowerSchool has strong presence)

- Learning Management Systems

- Assessment platforms

Growing categories:

- Intervention/tutoring (especially post-pandemic)

- SEL (social-emotional learning)

- Early literacy

- Data analytics/dashboards

Local players to know:

- Several NC-based EdTech companies have home-field advantage

- NC State, UNC, Duke have education research programs that sometimes produce spin-offs

Tips for Selling in NC

- Don't lump urban and rural together: A pitch that works in Wake County won't work in rural Tier 1 counties. Know your audience.

- Reference relevant peers: NC educators look to other NC districts. Name-drop strategically (with permission).

- Understand the political context: Education is politically contentious in NC. Stay neutral. Don't assume perspectives based on geography.

- Mind the university towns: Chapel Hill, Durham, and areas near major universities have highly educated, demanding parent populations. Expect sophisticated questions.

- Military districts have unique needs: Onslow, Cumberland, and other military-adjacent districts have transient populations. Mobility-friendly solutions matter.

- Hurricane planning is real: Coastal districts deal with disruption. Resilience and continuity features resonate.

- Summer is slow: July and August are particularly quiet. Plan your pipeline accordingly.

NC Resources for Ongoing Research

EduSignal's NC Coverage

EduSignal provides comprehensive profiles for all 115 NC LEAs, including:

- Enrollment and enrollment trends

- Per-pupil spending and revenue breakdown

- Academic proficiency (math and reading)

- Demographic composition

- School counts by level

- AI-powered sales analysis for your specific product

This guide is part of our State Spotlight series. As EduSignal expands to new states, we'll publish similar guides for Texas, California, Florida, New York, and beyond.