Texas Education Data Guide for EdTech Sales

Everything you need to know about the Lone Star State's 1,200+ school districts: structure, data sources, regional markets, and what makes Texas uniquely challenging, and rewarding, for EdTech sales,

Texas isn't just a state. It's a market unto itself.

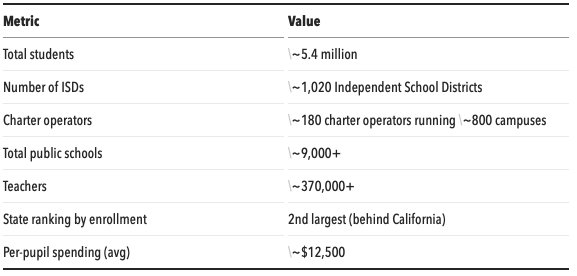

With over 5.4 million students across more than 1,200 school districts, Texas has more students than many countries and more districts than most states have schools. It's geographically massive, economically diverse, and educationally complex. Understanding Texas is essential for any EdTech company with national ambitions.

This guide covers everything you need to know to sell effectively in the Texas K-12 market.

---

The Basics: Texas at a Glance

Texas educates more than 10% of all American public school students. If Texas were a country, its education system would be one of the largest in the developed world.

---

Understanding Texas District Structure

Independent School Districts (ISDs)

Texas uses Independent School Districts as its primary organizational unit. Unlike some states where districts align with counties or municipalities, Texas ISDs are independent governmental entities with:

- Elected school boards

- Taxing authority (local property taxes)

- Significant operational autonomy

- Geographic boundaries that may or may not align with city limits

The word "independent" matters. Texas ISDs operate with substantial autonomy from state control, setting local policies within state frameworks.

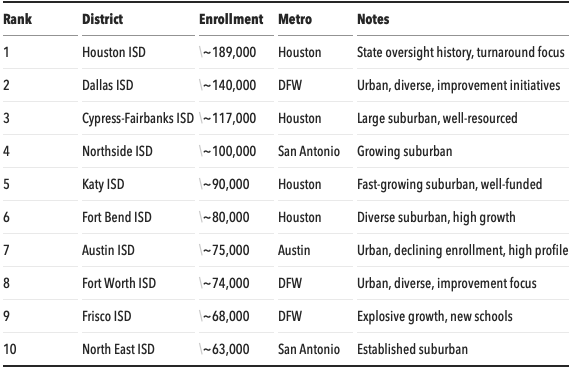

The Size Spectrum

Texas has extraordinary variation in district size:

Mega-districts (100,000+ students):

- Houston ISD (~189,000)

- Dallas ISD (~140,000)

- Cypress-Fairbanks ISD (~117,000)

- Northside ISD (San Antonio, ~100,000)

Large districts (25,000-100,000):

- Approximately 50 districts

- These include major suburban systems around Houston, Dallas, Austin, and San Antonio

Medium districts (5,000-25,000):

- Approximately 150 districts

- Mix of suburban, smaller urban, and larger rural systems

Small districts (1,000-5,000):

- Approximately 300 districts

- Smaller cities, towns, and consolidated rural areas

Very small districts (under 1,000):

- Approximately 500+ districts

- Many rural districts, some with fewer than 100 students

This size variation matters enormously. An approach that works for Houston ISD won't work for a 200-student rural district, yet both are Texas ISDs.

Charter Schools in Texas

Texas has a significant and growing charter sector:

- ~180 charter operators

- ~800 charter campuses

- ~400,000+ students (roughly 7-8% of public enrollment)

- State authorization (not district authorization)

Charter operators in Texas range from single-campus operations to large networks like KIPP, IDEA Public Schools, and Harmony Public Schools. IDEA alone serves 80,000+ students across 130+ campuses.

For sales purposes, charter networks often centralize purchasing decisions at the network level rather than campus level, making them distinct from traditional ISDs.

---

Texas Regional Markets

Texas's sheer size creates distinct regional markets with different characteristics:

Houston Metro (Greater Houston)

Population: ~7 millionMajor ISDs: Houston ISD, Cypress-Fairbanks, Katy, Fort Bend, Aldine, Spring Branch, Humble, Pasadena, Klein, Conroe

Characteristics:

- Largest metro student population in Texas

- Extraordinary diversity (Houston ISD is among the most diverse large districts nationally)

- Energy industry economy (creates boom/bust cycles)

- Significant bilingual/ESL populations

- Mix of urban, suburban, and exurban districts

- Hurricane vulnerability (affects budgets, planning)

Key districts:

- Houston ISD (~189,000): State's largest, significant challenges, state intervention history, turnaround focus

- Cypress-Fairbanks (~117,000): Large suburban, relatively affluent, well-resourced

- Fort Bend ISD (~80,000): Rapidly growing, diverse suburban, high expectations

- Katy ISD (~90,000): Fast-growing western suburb, strong reputation, well-funded

Dallas-Fort Worth Metroplex

Population: ~8 millionMajor ISDs: Dallas ISD, Fort Worth ISD, Arlington, Plano, Frisco, Lewisville, Richardson, Garland, Irving, McKinney, Denton

Characteristics:

- Second-largest metro by student count

- Corporate headquarters hub (creates high-expectation communities)

- Explosive northern suburban growth (Frisco, McKinney, Prosper, Celina)

- Urban core challenges (Dallas ISD, Fort Worth ISD)

- Significant wealth disparities between districts

Key districts:

- Dallas ISD (~140,000): Urban, diverse, improvement focus, significant Title I

- Fort Worth ISD (~74,000): Urban, second-largest in DFW, diverse challenges

- Plano ISD (~51,000): Affluent suburban, high performance, sophisticated buyers

- Frisco ISD (~68,000): Explosive growth (was 10,000 students in 2000), new school openings, well-resourced

- McKinney ISD (~27,000): Fast-growing northern suburb

San Antonio/Austin Corridor

Population: Combined ~5 millionMajor ISDs: San Antonio, Northside (SA), North East (SA), Austin ISD, Round Rock, Leander, Pflugerville, Judson

Characteristics:

- Austin: Tech hub economy, high education expectations, progressive politics

- San Antonio: Military presence (multiple bases), Hispanic majority, economic diversity

- I-35 corridor connecting the metros is rapidly developing

- Significant growth in suburbs between the two cities

Key districts:

- Austin ISD (~75,000): Urban, diverse, high-profile, but enrollment declining

- Round Rock ISD (~48,000): Fast-growing Austin suburb, tech community, well-resourced

- Leander ISD (~42,000): Explosive growth northwest of Austin

- Northside ISD (~100,000): San Antonio area, large suburban, one of state's largest

- North East ISD (~63,000): San Antonio suburban, well-established

Rio Grande Valley

Population: ~1.5 millionMajor ISDs: Brownsville, McAllen, Edinburg, Pharr-San Juan-Alamo, Harlingen, La Joya

Characteristics:

- Border region, predominantly Hispanic (90%+)

- High poverty rates, high Title I eligibility

- Large English Language Learner populations

- Tight-knit regional education community

- Often overlooked by EdTech vendors focused on major metros

Key districts:

- Brownsville ISD (~38,000): Border city, high poverty, strong bilingual programs

- Pharr-San Juan-Alamo ISD (~30,000): Consolidated district, significant challenges

- McAllen ISD (~23,000): Relatively more affluent for the Valley

- Edinburg CISD (~35,000): Consolidated district, university community

West Texas / Permian Basin

Major ISDs: Midland, Odessa, Lubbock, Amarillo, El Paso

Characteristics:

- Oil and gas economy (creates volatility)

- Sparse population, large geographic distances

- El Paso is isolated major metro (closer to Phoenix than Dallas)

- Midland/Odessa fluctuate with energy prices

- Many small rural districts

Key districts:

- El Paso ISD (~54,000): Border city, diverse, isolated from rest of state

- Midland ISD (~26,000): Oil economy, enrollment fluctuates with industry

- Lubbock ISD (~29,000): Texas Tech university community

- Amarillo ISD (~30,000): Panhandle hub

---

Texas Education Data Sources

Texas Education Agency (TEA)

The primary source for Texas-specific education data:

Website:

Key resources:

- Texas Academic Performance Reports (TAPR): Comprehensive school and district profiles

- PEIMS (Public Education Information Management System): The state's data collection system

- A-F Accountability Ratings: Annual school and district grades

- Snapshot: Annual summary of Texas public education statistics

- Financial reports: Actual financial data and FIRST ratings

Data freshness: TEA is relatively good about timely data release. Accountability ratings typically come out in August for the prior school year.

PEIMS: The Texas Data Backbone

PEIMS (Public Education Information Management System) is how Texas collects data from districts. Understanding PEIMS helps you understand what data exists:

PEIMS collects:

- Student demographic data (aggregate)

- Enrollment and attendance

- Course completion

- Staffing and compensation

- Financial data

- Special program participation

PEIMS submissions occur multiple times yearly, making Texas data relatively current compared to annual-only state systems.

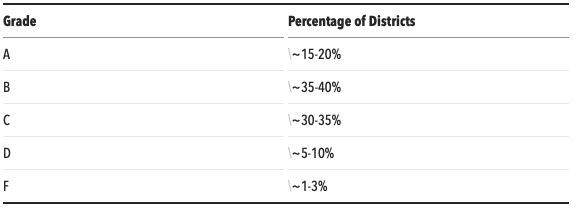

Texas School Accountability

Texas uses an A-F accountability system that's important for sales conversations:

How it works:Schools and districts receive letter grades based on three domains:

- Student Achievement (STAAR performance)

- School Progress (growth and relative performance)

- Closing the Gaps (performance across student groups)

Grade distribution (typical year):

Texas takes accountability seriously. Districts and schools with D or F ratings face significant state pressure and oversight.

Texas Assessment: STAAR

Texas uses the State of Texas Assessments of Academic Readiness (STAAR) for state accountability testing:

STAAR assessments:

- Grades 3-8: Reading and Math

- Grades 5 and 8: Science

- End-of-Course (EOC): Algebra I, English I, English II, Biology, U.S. History

Proficiency levels:

- Did Not Meet Grade Level

- Approaches Grade Level

- Meets Grade Level

- Masters Grade Level

For most purposes, "Meets Grade Level" is the key threshold for proficiency discussions.

---

Texas School Finance

Understanding Texas school finance helps you understand district budgets:

The Foundation School Program

Texas uses a complex funding formula called the Foundation School Program (FSP):

Basic allotment: A per-student base amount set by the legislature (~$6,160 in recent years)

Weighted funding: Additional funding based on:

- Special education

- Bilingual/ESL programs

- Compensatory education (economically disadvantaged)

- Career and technical education

- Gifted and talented

- Transportation

Local property taxes: Districts levy property taxes that interact with state funding in complex ways ("Robin Hood" recapture for property-wealthy districts)

Revenue Sources

Typical Texas ISD revenue mix:

- Local property taxes: 50-60%

- State funding: 30-40%

- Federal funding: 8-12%

This varies significantly based on property wealth. Property-rich districts may be "recaptured"—sending local tax revenue to the state for redistribution.

HB 3 and Recent Changes

House Bill 3 (2019) represented the largest Texas school finance reform in decades:

- Increased the basic allotment

- Provided teacher compensation increases

- Created additional weighted funding

- Reformed the recapture system

The result: increased per-pupil spending across most districts, though distribution remains uneven.

FIRST Ratings

The Financial Integrity Rating System of Texas (FIRST) evaluates district financial management:

- A = Superior

- B = Above Standard

- C = Meets Standard

- F = Substandard

FIRST ratings can indicate financial health and management quality. Districts with substandard ratings may face purchasing restrictions.

---

Texas's Largest Districts

Quick reference for the biggest opportunities:

The top 25 districts serve approximately 40% of Texas students.

---

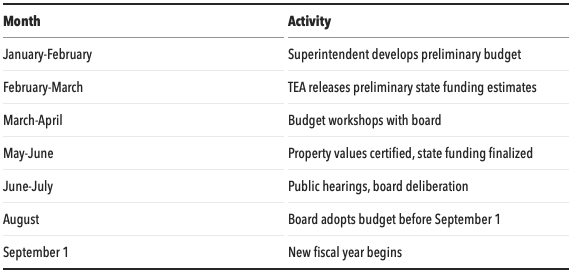

The Texas Buying Cycle

Fiscal Year

Texas school districts operate on a September 1 – August 31 fiscal year, different from most states (July-June).

Budget Timeline

Best Times to Engage

October-December: New school year underway, current year priorities clear, good for discovery and relationship-building

January-March: Budget planning season, next-year decisions taking shape

April-June: Procurement for next year, end-of-year spending decisions

July-August: Budget finalization, can be good for last-minute purchases; otherwise focused on back-to-school

Summer note: Texas education activity slows significantly in late June through mid-August. Schedule accordingly.

---

Texas Procurement

Purchasing Cooperatives

Texas makes heavy use of purchasing cooperatives that streamline procurement:

Major cooperatives:

- BuyBoard: Operated by Texas Association of School Boards (TASB), very widely used

- TIPS/TAPS: Serving regions across Texas

- DIR (Department of Information Resources): For technology purchases

- Region Education Service Centers: Each of 20 regions has procurement options

- Choice Partners: Houston-area focused

- TASB (Texas Association of School Boards): Various purchasing programs

Being on cooperative contracts can significantly accelerate sales cycles. Many Texas districts prefer or require cooperative purchasing for efficiency and compliance.

Purchasing Thresholds

Texas has relatively high informal purchasing limits:

- Under $50,000: Typically informal/competitive quotation

- Over $50,000: Formal competitive bidding usually required

Many EdTech purchases fall below formal bid thresholds, especially for individual campus or department purchases.

Board Approval

Larger purchases require school board approval. Texas boards typically meet monthly (often Monday evenings). Build board meeting schedules into your sales timeline.

---

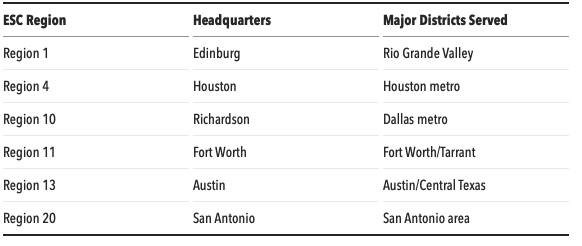

Education Service Centers (ESCs)

Texas is divided into 20 Education Service Center regions that support districts with:

- Professional development

- Technology services

- Purchasing cooperatives

- Curriculum support

- Special education services

ESCs are important players in the Texas education ecosystem:

Building relationships with ESC curriculum and technology specialists can create referral opportunities across their member districts.

---

Key Contacts and Decision-Makers

At the District Level

Superintendent: Ultimate authority, but typically engaged only for strategic or large purchases

Deputy/Assistant Superintendent for Curriculum & Instruction: Often the key decision-maker for instructional technology

Chief Technology Officer: Critical for infrastructure, systems, and many EdTech purchases

Executive Directors/Directors: Subject-specific leaders (Math, ELA, SPED, Bilingual) with significant influence

Federal Programs Director: Essential contact for Title I and federal grant-funded purchases

Principals: Increasingly have discretionary budgets, especially in larger districts

Important Texas-Specific Roles

Chief Academic Officer: Common in larger Texas districts, oversees all academic programs

Bilingual/ESL Director: Given Texas demographics, this is a significant role in many districts

Assessment Director: Texas's testing focus makes this an important position

---

Selling to Texas: Key Considerations

1. Size Your Effort Appropriately

Don't treat a 500-student rural ISD the same as Houston ISD. The mega-districts require enterprise sales motions; small districts can often be won through quick, efficient processes.

2. Understand Bilingual Needs

Texas has the largest ELL population in the country (~1 million students, ~20% of enrollment). Products without Spanish language support or bilingual features face significant limitations.

3. Leverage Cooperatives

Getting on BuyBoard, TIPS, or DIR contracts opens doors. Texas districts strongly prefer cooperative purchasing for its efficiency and compliance simplicity.

4. Respect Regional Differences

The Valley is different from West Texas is different from Houston is different from the Dallas suburbs. Local context matters.

5. Know the ESCs

Education Service Centers can be allies or competitors depending on your product category. They offer their own services that may overlap with commercial offerings.

6. Navigate Politics Carefully

Texas education is politically charged (school choice debates, curriculum controversies, testing battles). Stay neutral and focus on student outcomes.

7. Account for Growth

Many Texas districts are in growth mode, opening new schools regularly. Track new school construction as a prospecting signal.

8. Prepare for Scale

If you win a major Texas district, be ready to deliver at scale. Houston ISD alone has 274 schools. Implementation capacity matters.

---

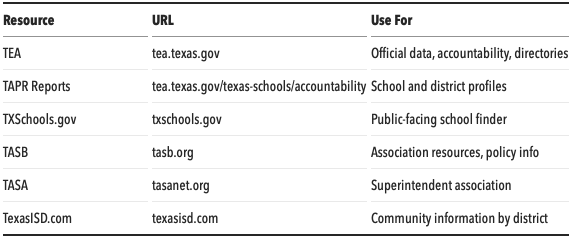

Texas Resources for Research

---

EduSignal's Texas Coverage

EduSignal provides comprehensive profiles for Texas ISDs, including:

- Enrollment and enrollment trends

- Per-pupil spending and revenue breakdown

- Academic proficiency (math and reading)

- Demographic composition

- A-F accountability ratings

- School counts by level

- AI-powered sales analysis for your specific product

---

This guide is part of our State Spotlight series. We publish comprehensive guides for each state as EduSignal expands coverage.